Sportswear giant Nike, Inc. is at the center of a class action lawsuit tied to its digital collectibles initiative, with potential legal consequences for the broader non-fungible token (NFT) industry.

Filed on April 25, 2025, in the U.S. District Court for the Southern District of New York, the Nike NFT class action case alleges that the global sportswear company sold NFTs through its digital brand RTFKT, which should have been registered as financial securities. The lawsuit claims that Nike’s actions led to significant investor losses after the abrupt shutdown of RTFKT in late 2024.

The case, Fernandez et al. v. Nike, Inc., accuses the latter of misleading marketing practices and violating consumer protection laws in multiple states. In the first version of the case, plaintiff Jagdeep Cheema, on behalf of the other plaintiffs, argued that thousands of consumers were left holding worthless digital assets and that Nike failed to warn them of the associated risks.

This RTFKT lawsuit seeks more than $5 million in damages and could shape how courts and regulators treat NFTs in the future.

RTFKT and Nike’s Digital Expansion

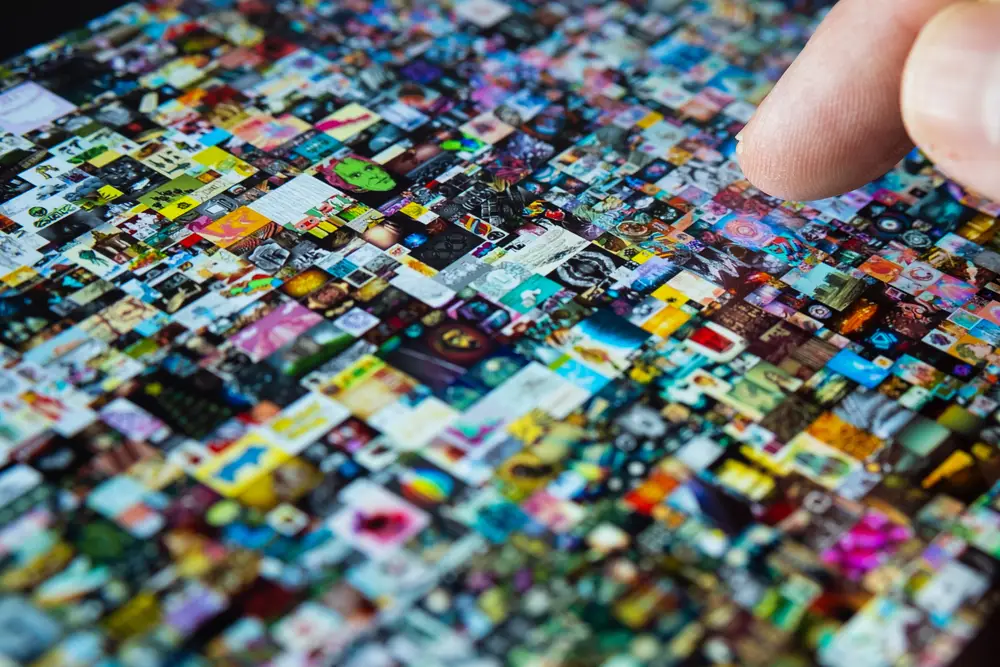

RTFKT (pronounced "artifact"), a digital fashion startup acquired by Nike in late 2021, was at the center of Nike’s push into blockchain-based assets. The brand allowed users to collect, trade, and display digital sneakers and accessories in the metaverse. Through RTFKT, Nike released themed NFTs that could be used in challenges to unlock prizes like limited-edition physical Nike gear.

Buyers believed these NFTs would increase in value as Nike continued to invest in digital experiences. However, in December 2024, RTFKT announced it was winding down operations via a brief statement on its official X account titled “A New Chapter for RTFKT.” With little warning, the project came to an end.

And it all happened while NFT values quickly collapsed.

Allegations of Securities Violations and Deceptive Marketing

According to the lawsuit, Nike failed to disclose that its NFTs might qualify as securities under U.S. law. The plaintiffs claim that the digital assets derived their value from Nike’s brand and promotional activities, and should therefore have been registered with the U.S. Securities and Exchange Commission (SEC).

The Nike digital collectible lawsuit further asserts that investors lacked access to essential financial disclosures typically required when securities are sold to the public.

The plaintiffs describe the incident as a “soft rug pull,” a term in crypto used when promoters abandon a project after raising funds, causing investors a sharp loss in value. As the case claims, Nike capitalized on the NFT boom and marketed the assets with investment-like incentives without warning of possible risks or ensuring compliance with financial regulations.

The complaint also accuses Nike of deceptive marketing practices by failing to clearly state the speculative nature of its NFTs and suggests that many consumers would not have purchased the tokens if fully informed.

Lead Plaintiff Changes and Case Developments

Since the Nike NFT securities case was filed, several key developments have taken place in court, including procedural updates and a change in lead plaintiffs.

June 2025

- Nike requests a pre-motion meeting (June 6)

- Judge denies delay request (June 10)

- Cheema responds (June 13)

- Judge advises case consolidation (June 20)

- Cases merged under Cheema v. Nike (June 26)

July 2025

- Cheema exits the case (July 10–11)

- Case renamed Fernandez et al. v. Nike, Inc. (July 16)

- Pre-motion meeting denied (July 21)

- Amended complaint due August 11; next steps by August 25

Industry Impact: NFTs, Securities Laws, and Risk Disclosure

If the court determines that the NFTs in question qualify as securities, it may prompt sweeping changes in how digital assets are issued and regulated in the U.S. This would affect disclosure obligations, investor protections, and registration requirements for future NFT projects.

The Nike RTFKT shutdown brought renewed attention to NFT investment risks, especially for retail buyers who may not understand the financial or legal frameworks behind digital collectibles. Legal observers note that many NFT projects have skirted regulation by labeling themselves as art, collectibles, or experiences, even when sold with clear investment appeal.

As the SEC and NFTs remain a hot topic in regulatory debates, this case could become a cornerstone for shaping future guidelines.

A Turning Point for NFT Regulation and Consumer Rights

The RTFKT lawsuit raises critical questions about the responsibilities of large companies entering emerging technologies.

Plaintiffs argue that Nike used its trusted brand and marketing power to promote high-risk, unregulated financial products to consumers without providing the transparency and accountability required under law.

The potential consequences of the digital asset class action are wide-ranging. If successful, the case could establish a precedent that forces companies to register NFTs as securities and include risk disclosures before promoting them as investment opportunities.

Where It Goes From Here

Unless resolved through dismissal or settlement, Fernandez et al. v. Nike, Inc. will proceed into discovery and potential hearings in the coming months. Courts could award damages to thousands of affected investors if plaintiffs prevail in this Nike NFT class action lawsuit and similar cases. More importantly, it would signal to other companies that legal accountability in the NFT space is no longer avoidable.

For many in the cryptocurrency and blockchain community, this lawsuit is more than a consumer grievance—it’s a pivotal test of what digital assets really are under the law. For everyday buyers, it highlights the risks of investing in hype-driven projects without adequate regulatory oversight.

Frequently Asked Questions (FAQ)

Non-fungible tokens (NFTs) are unique digital assets recorded on a blockchain. Often tied to digital art or collectibles, including items used in virtual spaces like the metaverse, NFTs are not interchangeable. Metaverse NFT lawsuits have emerged as legal scrutiny increases around their use, especially when marketed as investments without proper disclosures.

Nike was sued over alleged deceptive marketing of NFTs through its RTFKT brand. The lawsuit claims the company promoted unregistered securities without warning buyers of the risks. Plaintiffs argue that the lack of NFT legal regulation and proper disclosures led consumers to believe in long-term value, qualifying them for potential RTFKT NFT refunds.

While Nike’s abrupt shutdown of RTFKT was a major trigger, the broader market downturn also played a role. Still, plaintiffs allege Nike's actions, including deceptive marketing of NFTs, directly misled consumers. The RTFKT NFT refund/settlement demand stems from Nike’s role in the collapse and lack of compliance with NFT legal regulations.

Add Comment